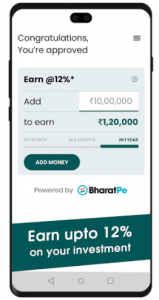

12% Club, fueled by BharatPe and in association with RBI endorsed NBFCs offers you an answer for all your speculation and acquiring needs

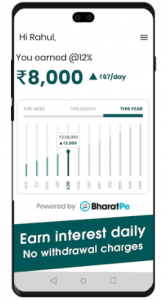

Contribute @12%

– Put away cash whenever and begin procuring revenue every day

– Begin contributing from as low as Rs. 1,000

– Get upto 12% premium per annum (Interest is gathered day by day)

– Demand withdrawal whenever, no withdrawal charges

– In association with RBI endorsed NBFC (LendenClub: Innofin Solutions Private Limited and Liquiloans: NDX P2P Private Limited )

Get @12%

– Get cash whenever @12% premium

– Reimburse whenever, no prepayment charges

– Zero handling charges

– Cooperated with RBI supported NBFC (Mufin Finance: Hindon Mercantile Limited)

How to turn into a 12% Club Member?

– Download the 12% Club App

– Information exchange utilizing your Mobile number and OTP

– Make your 12% Club account by connecting your Bank record, PAN and finishing KYC

– Acknowledge T&Cs

– Begin contributing or getting @12%

Advance Details

Advance sum: From Rs.10,000 to Rs.100,000

Residency: 90 days (fixed)

Reimbursement: 1 single installment at end of 90 days

APR and different charges

Loan fees (APR): fixed 12% per annum

Handling charges : 0

Punishment is charged when somebody postpones their planned installment. Also, GST will be appropriate according to Indian laws.

Model

Advance Amount: Rs. 100,000

Residency: 90 days

Loan cost (APR): 12% each year (Flat rate). This means 3% in 90 days

Reimbursement Amount: Rs. 103,000

Absolute Interest Payable: Rs. 100,000 x 12%/12*3 (90 days) = Rs. 3,000

Handling Fees (incl. GST): Rs. 0

Dispensed Amount: Rs. 100,000 (Loan Amount) – Rs. 0 (Processing Fees) = Rs. 100,000

Aggregate sum Payable: Rs. 103,000 (1 single installment toward the finish of 90 days)

Complete Cost of the Loan = Interest Amount + Processing Fees = Rs. 3,000 + Rs. 0 = Rs. 3,000

12% Club is a trendy advanced stage that gives you simple admittance to Instant Personal Loans of up to Rs.100,000 in a consistent and straightforward way.

Individual Loan Features

Up as far as possible

Moment cash move to a financial balance

100% paperless cycle

Insignificant documentation. No printouts required

Shot reimbursement at end of 3-month residency

Moment qualification check

No guarantee

No prepayment charges

Qualification

1. Indian resident

2. Age over 21 years

3. Select urban areas