The financing cost on fixed stores is declining each month. At this point, KTDFC is a non – banking monetary establishment under the Government of Kerala with a loan fee of over 7% on fixed stores. The loan cost on KTDFC for 1 year to 3 years is 8% for the overall population and 8.25% for senior residents. You can contribute for a time of as long as 5 years. Further subtleties of the intrigue are given beneath.

The enthusiasm on the store can be acknowledged month to month, quarterly or together at development time. 75% of the store sum can be obtained from a quarter of a year after the store. The enthusiasm on the credit will be 2% higher than the enthusiasm on your store. You can likewise make a venture through a KTDFC specialist. The following is the connection to download the store structure.

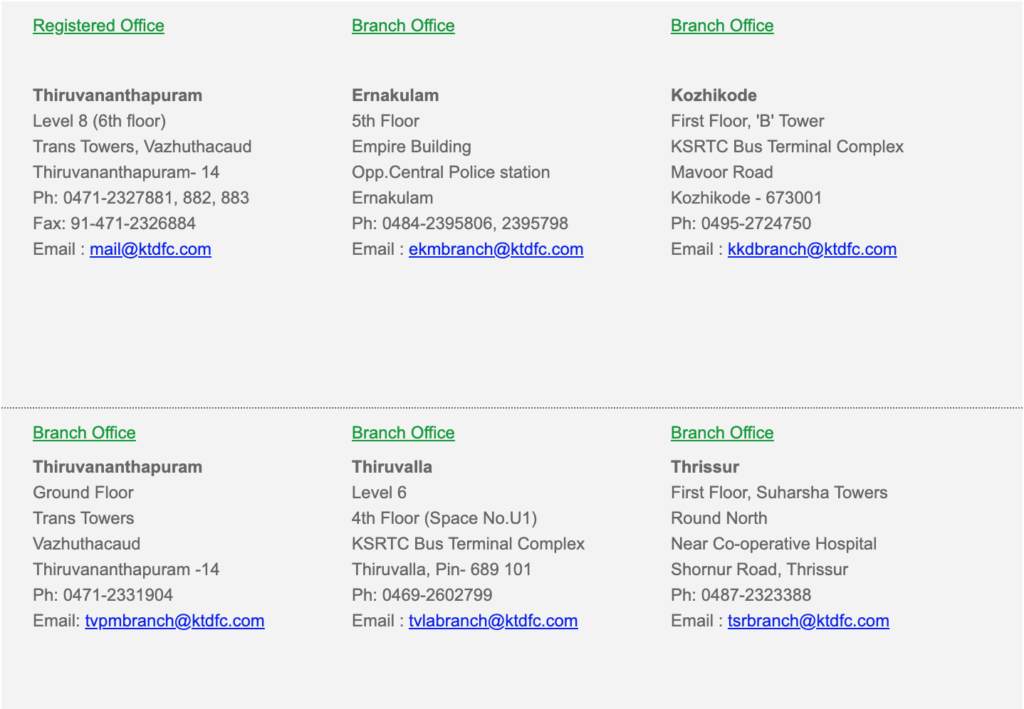

The details of KTDFC branches are given below

On the off chance that your enthusiasm for a monetary year is above Rs 40,000, you need to pay 10% TDS. The following is the connection to download the structure.